Discounts offered to Military, First Responders and Seniors (65+)

Financing Options

Pro-Safe now offers financing options including interest free for 12 months, follow the link to get started!

Report: 89% of Homes Are Under Insulated

New research sponsored by NAIMA and conducted by ICF Consulting shows that 89 percent of U.S. single-family homes are under-insulated, decreasing comfort while increasing energy costs for homeowners.

Considerable savings potential for existing homes. Save $33.42/sq. ft.

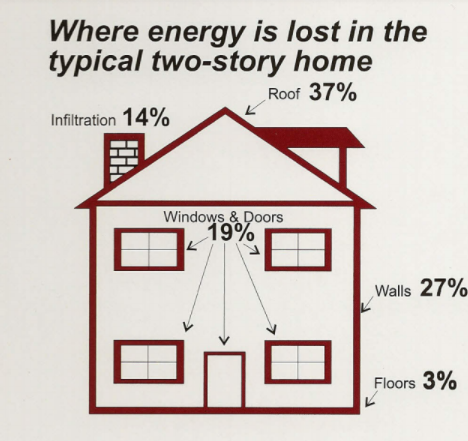

ICF estimates that energy savings ranging from 10 to 45 percent can be achieved in existing homes that are air sealed and have insulation added in the ceiling and floors (and walls in limited circumstances) to levels prescribed by the 2021 International Energy Conservation Code.

Learn MoreWhy insulate/ventilate your home?

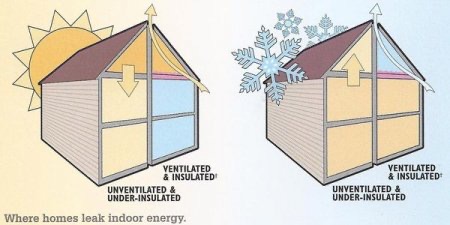

Your home is most likely your biggest investment. Like any big investment, improvements are necessary to ensure your home keeps its value and great condition. Improper insulation and ventilation can cause air leaks, condensation, mold growth and reduce the life of your roof, air conditioner and furnace.

Air Leakage / Ventilation

- Drafts and cold spots

- Ice dams may occur, leading to roof and ceiling leaks

- Moisture problems leading to peeling paint, mold, mildew, or structural damage in walls and attic

- Uncontrolled air exchange causing unhealthy air quality, high humidity or dryness

- Proper exhaust ventilation in bathrooms and kitchen is needed to control moisture and pollutants

- Freezing pipes are caused mostly by air leaks

Inadequate Insulation Levels

- Heat is lost in the winter and gained in the summer, causing heating and cooling equipment to work harder than necessary and increasing energy bills

- Cold exterior walls lead to discomfort and increased heating use

- Missing insulation in attics leads to hot rooms and increased air conditioner use